Student loan income based repayment calculator navient

Please note that once you refinance your federal loans they are no longer eligible for forgiveness programs or income-driven repayment. Keep in mind that you do not need to repay the debt when you are still studying or six months have not yet passed since graduation.

Ibr Vs Icr How To Choose The Right Repayment Plan Student Loan Hero

Fixed interest rates are 349 824 APR 324 799 APR with Auto Pay discount.

. For instance the repayment plan is based on 10-15 of the discretionary income. In this way borrowers can meet. In finance a loan is the lending of money by one or more individuals organizations or other entities to other individuals organizations etc.

Sallie Mae offers fairly standard interest rates. Private Student Loans. The document evidencing the debt eg a promissory note will normally.

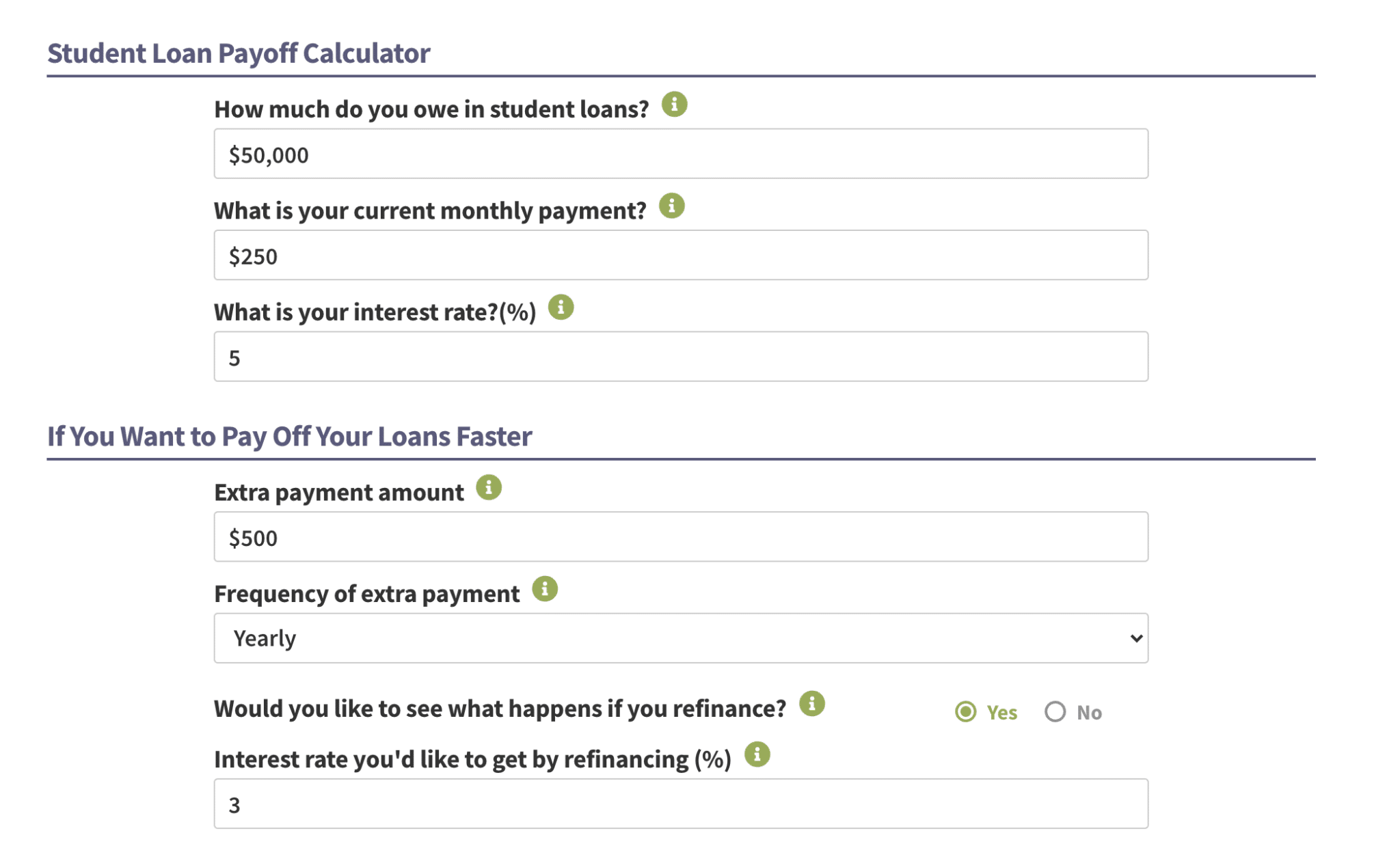

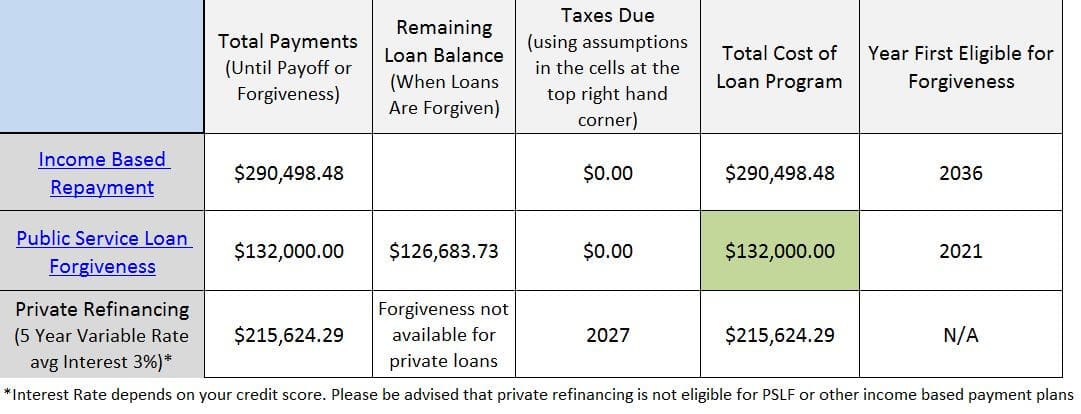

Stay on income-driven repayment which depending on the plan will forgive your remaining balance after 20 or 25 years. Student Loan Income-Based Repayment IBR Calculator. That puts the average monthly payment nearly 55 higher than it was a decade ago.

Under this law existing borrowers rates dont change. Debtors also mostly get the help of Income-Based Repayment plans because this program fits their revenue levels. Its average variable loan rate falls between 325 - 1359 APR.

Not based on your username or email address. Find out with our Income-Based Repayment Calculator. You can choose between fixed and variable rates.

Student loans are a serious responsibility and as with any loan you are expected to pay it back on time even if you dont graduate or find a job right away. As mentioned before this ITT Tech Student Loan Forgiveness program requires 120 qualifying payments. For borrowers who struggle to afford their loan after graduating RISLA is one of the only private lenders to offer an income-based repayment plan which limits payments to 15 of income for a 25.

It means each payment should be made on time in full amount and under Income-based repayment plans. When your school determines your financial aid award which includes scholarships grants work-study and loans it uses a standard budget to estimate your expenses or your cost of. Federal Student Aid.

Student loan payments have increased more than two-and-a-half times faster than the rate of inflation. Borrowers must have had at least one federal student loan that was eligible for income-driven repayment between October 2009 and January 2017 but they were instead steered into a forbearance as a. Rates on newly disbursed Direct Loans are recalculated ahead of each school year and tied to the yield on 10-year Treasury notes.

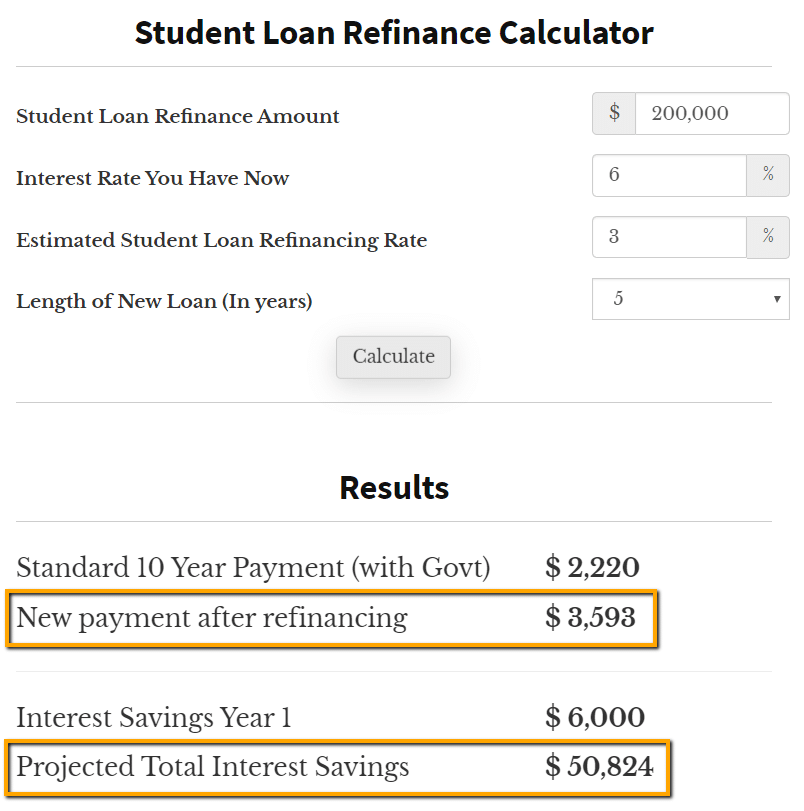

The recipient ie the borrower incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. For fixed-rate loans the rates are typically between 375 to 1372 APR. Consider refinancing your student loan to lower your interest rate.

A new federal student loan interest rate structure was introduced with the Bipartisan Student Loan Certainty Act of 2013. The average monthly student loan payment was 393 in 2016 the latest data available which is like buying the newest Apple Watch every two months.

Which Is The Best Income Driven Repayment Plan For Your Student Loans Student Loan Hero

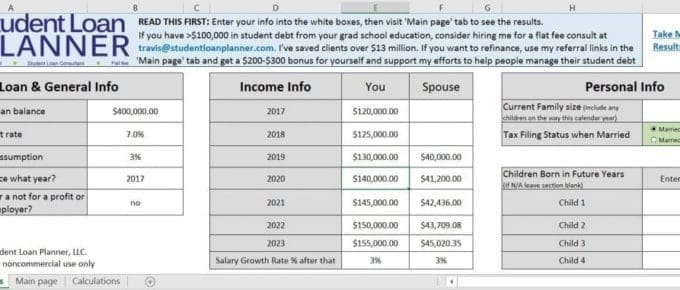

Student Loan Payoff Calculator Updated For 2022 Student Loan Planner

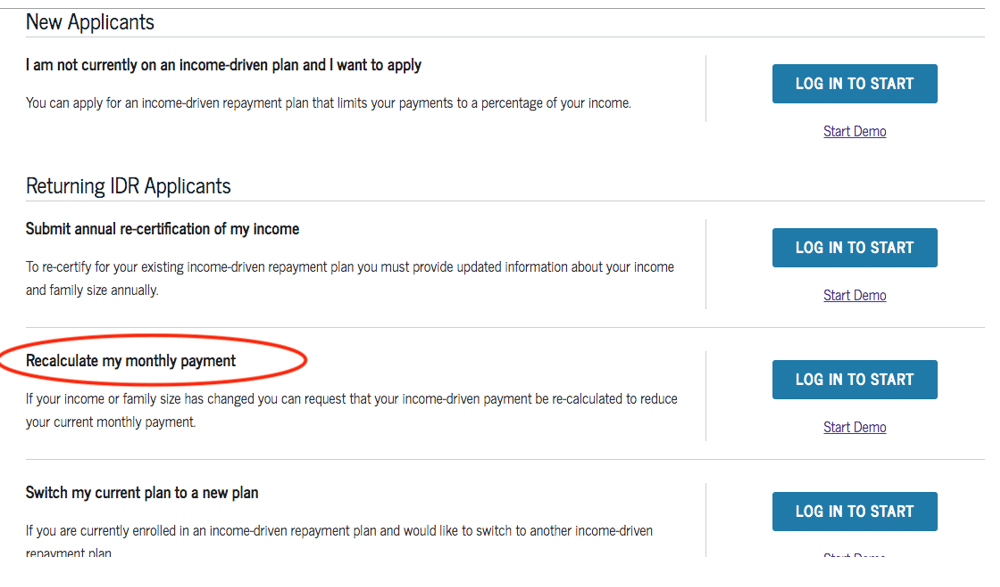

Managing Your Account Navient

Biden Idr Student Loan Forgiveness Calculator 2022

Managing Your Account Navient

/Private-vs-Federal-College-Loans-Whats-the-Difference-31c92251f6b243e3b1e4bba3b5612791.jpg)

Private Vs Federal College Loans What S The Difference

Income Based Repayment Of Student Loans Plan Eligibility

Navient Student Loan Settlement Who Qualifies For Relief And What To Do

How To Lower Your Student Loan Payment Due To Coronavirus Income Loss Student Loan Planner

Everything You Need To Know To Manage Your Navient Student Loans Tun

Student Loan Forgiveness 5 Questions On The Navient Settlement

Pros And Cons Of Income Driven Repayment Plans For Student Loans

Free Calculators To Do Your Student Loan Forgiveness Math For You Student Loan Hero

Income Based Repayment Calculator Includes Biden Ibr Plan

Biggest Mistakes Doctors Make With Their Student Loans In Residency

How Much Will My Student Loan Payment Be Student Loan Planner

How To Lower Student Loan Payments Credible